History of Regional Bond Authorities in Illinois

Regional Bonding Authorities in Illinois

In the early 1990s the State of Illinois created several Regional Development Authorities (Regional Authority). The State still had the state-wide authorities such as the Illinois Housing Development Authority (IHDA) and the Illinois Development Finance Authority (IDFA) that provided products for certain types of projects (i.e., IHDA bonded housing deals and IDFA bonded manufacturing deals, etc.).

The Illinois General Assembly thought there were certain areas of the state that needed extra tools for economic development, so they created smaller “mini” bonding entities that could help multiple types of projects, but only on a specific geographic region. Much of the powers of the Regional Authorities are broad and able to finance manufacturing, housing, not for profit, public facility and solid waste projects, to name a few

The Regional Authorities have certain powers under their act to build bridges, enter into certain types of intergovernmental agreements, but the main product they provide is the issuance of bonds to help borrowers get a lower interest rate.

The Regional Authority doesn’t have a bucket that is full of money that they lend out. They create an instrument, called a bond, that investors can buy. The major buyers of Regional Authority bonds are mutual funds and insurance companies that buy these investments because they are in the category of tax-free bonds.

When I hear the term “tax-free” the first thing that comes to mind is when you donate money to a church and deduct that donation from your income for tax purposes. This is not what is meant by the term “tax-free bond.” The “tax-free” part of a bond is related to the benefits that the investor (or buyer of the bond) would receive.

A mutual fund or insurance company that buys a tax-free bond receives interest income on which it does not have to pay federal income tax.

An easy example is if a mutual fund buys an investment that pays a 6% return, but they have to pay 2% in federal income tax, then the net after-tax yield is 4%. However, if they buy a 4% “tax-free” bond, both investments are identical. When all of the dust settles, both investments provide a 4% return. The only difference is on the flip-side: one borrower gets to borrow at a 4% rate instead of a 6% rate, thus saving 2% on the cost of their financing.

The reason why this method of financing is available is because when Congress passed the Federal Tax Code, it felt there were certain activities that are so important to the United States economy, that they should be able to receive this type of favorable financing.

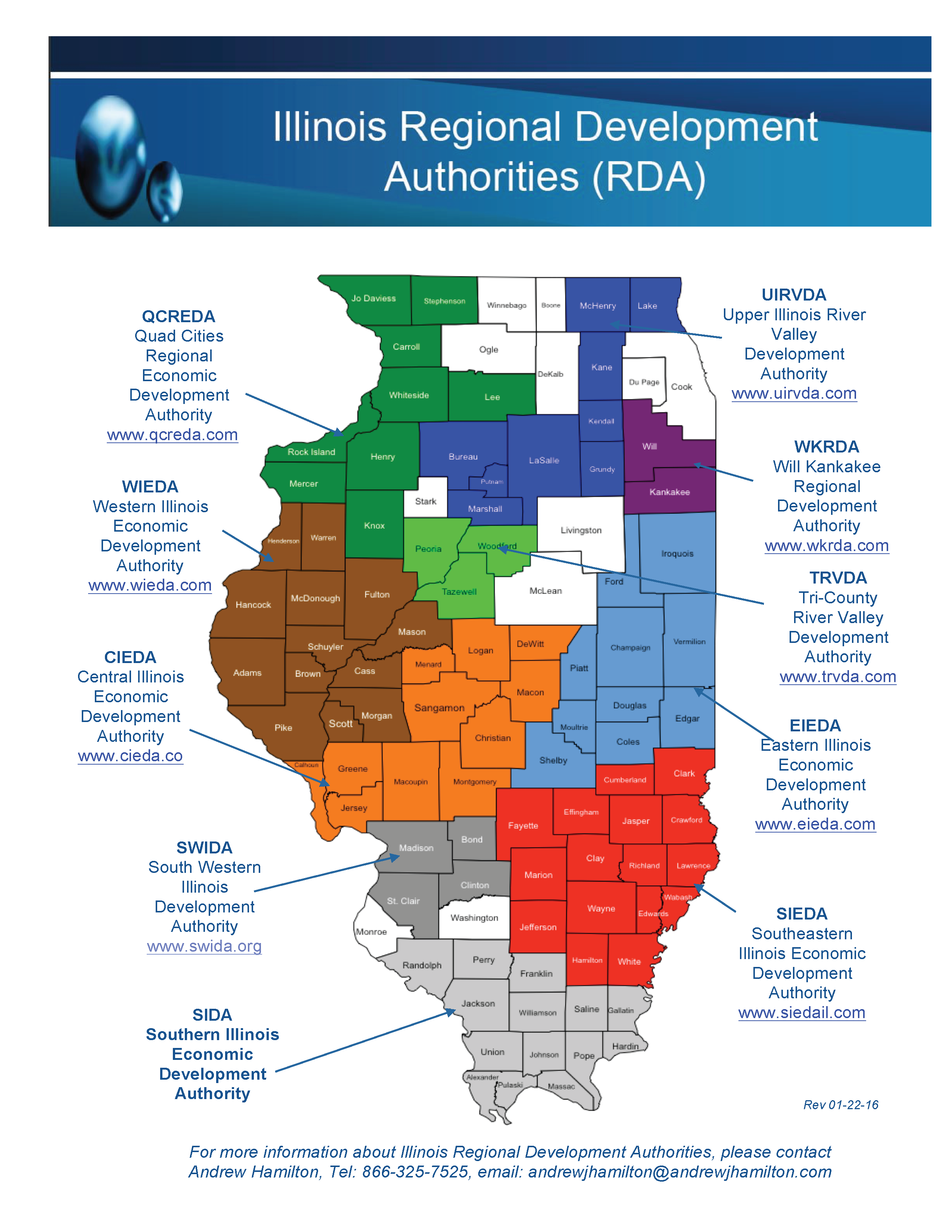

The first two Regional Authorities created in the late 1980s were the Southwestern Illinois Development Authority (SWIDA) www.swida.org that covered Madison and St. Clair Counties and the Quad Cities Regional Economic Development Authority (QCREDA) www.qcreda.com that covered Rock Island, Henry, and Mercer Counties.

These first two Authorities received appropriations from the state to cover their start up operations, but this was a one time instance. A few years later, another three Regional Authorities were created: the Upper Illinois River Valley Development Authority (UIRVDA) www.uirvda.com which covered five counties of Bureau, Grundy, LaSalle, Marshall and Putnam, the Will Kankakee Regional Development Authority (WKRDA), www.wkrda.com which covered the two counties of Will and Kankakee and the Tri-County River Valley Development Authority (TRVDA) which covered the three counties of Peoria, Woodford and Tazewell www.trvda.com.

These three additional Regional Authorities lay dormant for several years due to lack of funding until the early 1990s. Over the next almost decade there were minor changes to the Regional Authority legislation. UIRVDA added Kendall, Kane and McHenry counties to become an eight county Authority, SWIDA added Bond and Clinton counties. QCREDA initially added Knox and then in 2011 expanded to cover Carroll, Lee, Jo Daviess, Stephenson and Whiteside counties. Additionally, the Illinois Development Finance Authority (IDFA) was consolidated with the Illinois Health Facilities Authority, the Illinois Educational Facilities Authority, the Illinois Rural Bond Bank, the Illinois Industrial Park Authority and other state wide Authorities to form the Illinois Finance Authority (IFA).

In 2004, the State created the Western Illinois Economic Development Authority (WIEDA) www.wieda.com and the Southeastern Illinois Economic Development Authority (SIEDA) www.siedail.com WIEDA received an appropriation from the State for their start up operations.

In 2005, the State created the Eastern Illinois Economic Development Authority (EIEDA) www.eieda.com and in 2006, the state created the Central Illinois Economic Development Authority (CIEDA) www.cieda.co and the Southern Illinois Economic Development Authority (SIDA). As of 2011, eighty five percent of all Illinois counties are geographically represented by a Regional Authority.

SWIDA is the only Regional Authority with full time staff. UIRVDA, QCREDA, WKRDA, SIEDA, EIEDA, CIEDA, WIEDA and TRVDA have part-time staff. The Illinois Regional Authorities do not have taxing powers, do not generally receive operational appropriations from the state and are operationally self-sufficient. They operate solely on fees they charge to borrowers to issue bonds that provide the borrower with an interest rate lower than conventional financing. Since the fees that are charged are much less than the benefit that the borrower receives, the borrower is delighted to pay the issuance fee.

Generally, the break-even point to the borrower on the cost of issuing a bond is within the first year. Most Regional Authority budgets are lean, primarily covering the cost of staff and minor marketing activities.

When a Regional Authority issues a bond on behalf of a borrower, they are NOT LIABLE for any type of repayment in the case of default. Most of the Regional Authority’s outstanding bonds are backed by a bank letter of credit. If there is a deficiency in collateral or debt service, the bank is the entity that experiences a loss. Banks do not generally view a Regional Authority as a competitor because the bank has to be part of the transaction by providing a irrevocable letter of credit to back the bonds. The institutional buyers of municipal bonds generally require credit enhancement. The most common form of credit enhancement is a bank letter of credit.

To put it plainly, the bond buyer could care less whether the borrower pays them or not because if the borrower fails to pay, then the bank will make the payment and then foreclose on the borrower. The bond buyer cares more about the financial strength of the bank than the borrower.

In order to become part of an existing Regional Authority or create a new one, there must be an Act passed by the Illinois General Assembly and signed by the Governor.

More details on the authority’s services please contact Andrew Hamilton at 866-325-7525 or visit www.wieda.com.